living benefits life insurance dave ramsey

living benefit life insurance 2020

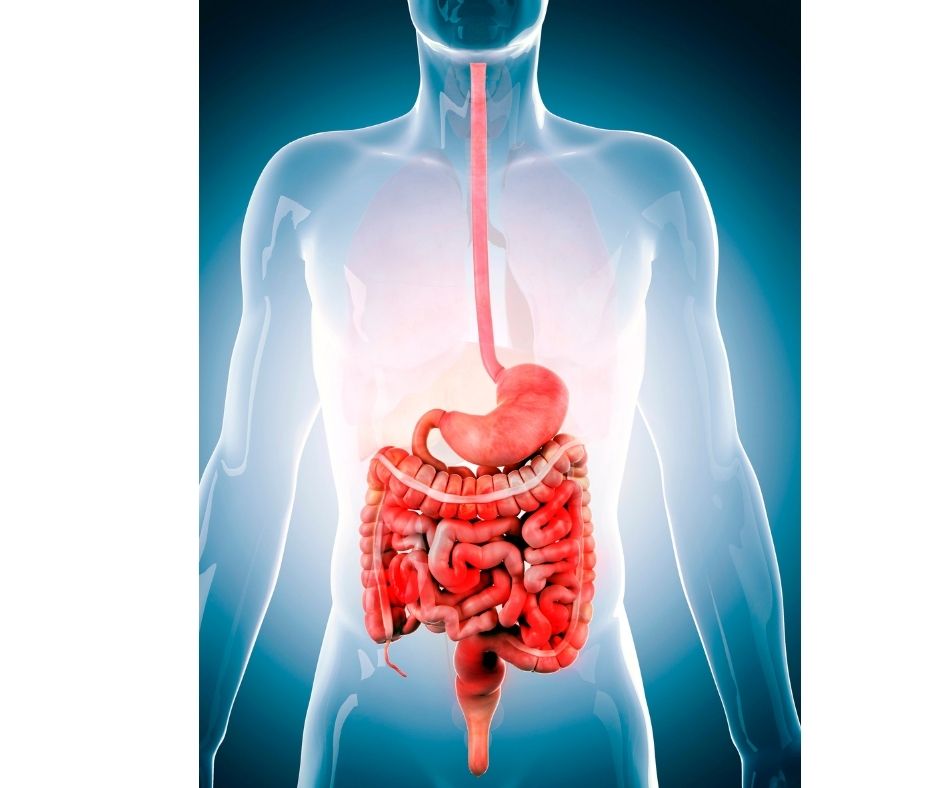

Perhaps you have an understanding of the advantages of life insurance. For example, how it can help to protect your loved one's assets if you die financially. However, life insurance can also offer benefits for those still alive.

Permanent life insurance policies provide the option to receive accelerated death benefits, just like term insurance.

Your life insurance policy may automatically include specific living benefit riders at no extra cost. To qualify, you'll need proof of the severity of your illness. You may be allowed to withdraw up to 80% of your policy proceeds if you can.